Employers in Singapore are preparing for their yearly IR8A submissions for the 2025 tax season, and if you feel stressed about the same, calm down, for you are not the only one. Let’s break down this important tax requirement into less daunting steps which will help you to make your submission a sail-through.

All About IR8A That You Need to Know

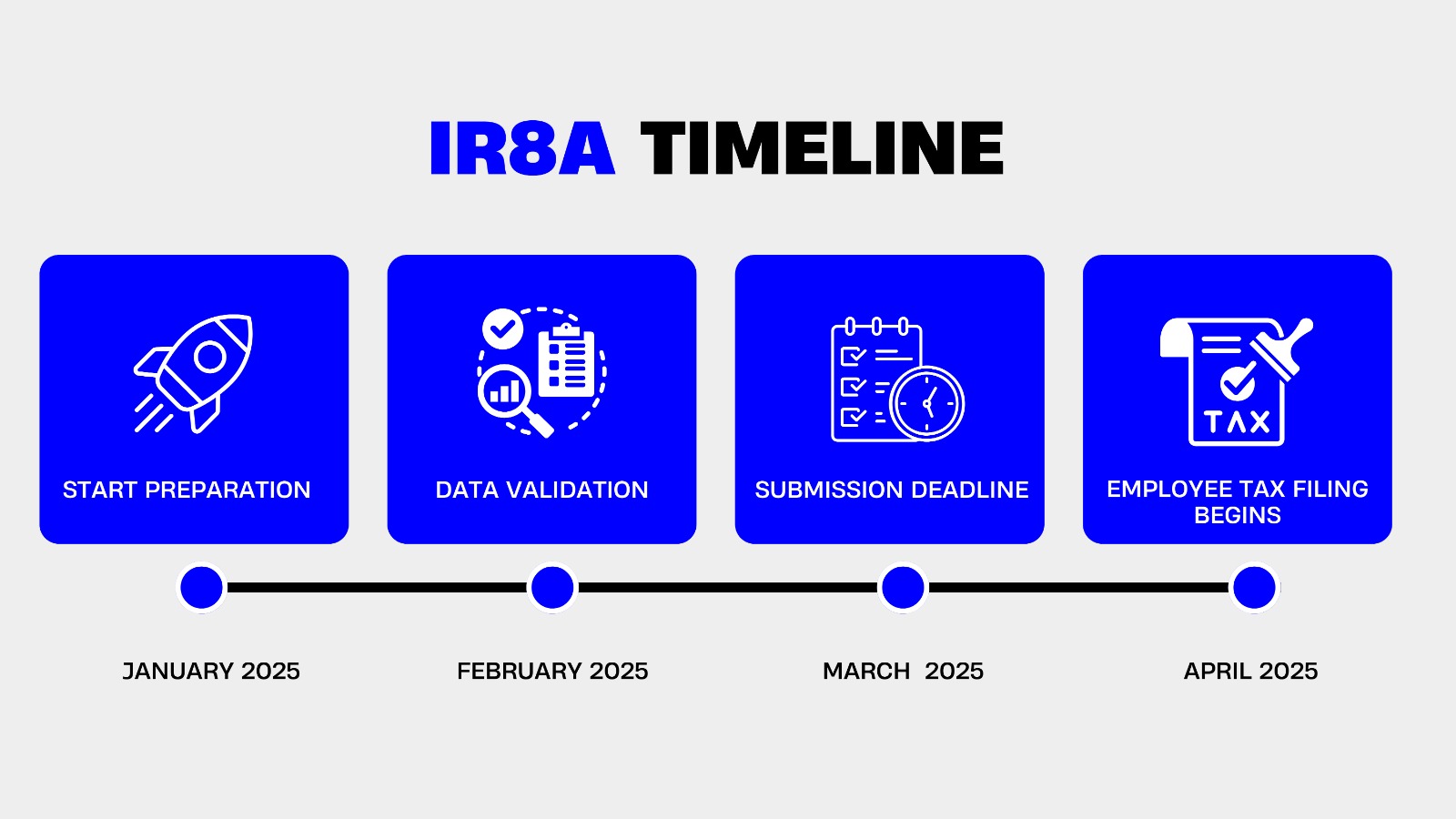

Before going into details regarding submission, it’s essential to know what IR8A is. The IR8A is a mandatory form submitted by all employers in Singapore, declaring their employees’ employment income for the previous year. On submission, tax authority IRAS requires it to be submitted by 1 March 2025.

Changes Following 2025

The Inland Revenue Authority of Singapore (IRAS) has introduced many changes to streamline the submission process. One of the most significant changes is that all employers must electronically submit the IR8A forms under the Auto-Inclusion Scheme (AIS). The days of paper submission are now gone; that is a huge shift towards digitization.

Submission in Steps

1. Gather Documentation

For the submission process, ensure you have collected the following information:

- Personal particulars of your employees, including identification numbers.

- Records of their annual employment income.

- Details of their benefits-in-kind.

- Records of any commission and bonuses they have been paid.

- Director’s fees, where applicable.

2. Log on to AIS

Apply for the myTax Portal login using your CorpPass account. CorpPass is now the only accredited login for corporate transactions with government bodies, according to the Ministry of Finance.

3. Validate Data

Before submitting, ensure data validation under IRAS requirements seems good, meaning the following:

- Make use of the Data Validation Tool offered by IRAS.

- Check for any common errors, like incorrect date formats.

- Verify that all mandatory fields are filled in.

4. Submit Your Returns

Pick the option through which you want to submit your documents:

- Directly on myTax Portal.

- API Submission, which is for Corporates.

- Excel Upload or PDF upload for smaller-sized companies.

Also Read: Navigating the CDAC Contribution Rate: A Comprehensive Overview

Pitfalls to Avoid

1. Missing Benefits-in-Kind

Keep in mind non-monetary benefits such as housing allowances, car perks, insurance premiums, and share options.

2. Improper Classification

Make sure that you properly classify the different types of income. The Singapore Business Federation has helpful information on properly classifying income.

Submission Tips

- Start Early: Start collecting information well before the submission deadline. The Singapore National Employers’ Federation recommends starting at least two months before the deadline.

- Recordkeeping: Update payroll records periodically so that you do not have to rush things at the last minute.

- Stay updated: Subscribe to IRAS updates and announcements in order to keep up with changes or requirements.

Also Read: How Can On the Job Training Improve Employee Performance?

What To Do After Submission

Make sure you:

- Keep copies of submission confirmation receipts

- Advise employees that their income has been reported

- Prepare for inquiries that may arise from IRAS

How to Seek Help

If you run into problems with submission, there are several resources that can be helpful:

- IRAS e-Services Helpdesk

- IRAS Virtual Assistant

- Tax service professionals

Conclusion

IR8A submission may seem like a nightmare, but with these guidelines, it becomes more bearable. As such, accurate and timeous submissions help you remain compliant and help employees render their personal income tax returns without any inconvenience.

Never forget to review your submission and catch up with IRAS updates. With a handy checklist and a decent time buffer before the deadline, you will go through 2025 IR8A submission unscathed.

For the latest updates and detailed information, visit the IRAS website or consult with your tax professional.

5

5