HR Guide to Payroll in Singapore 2025: A Comprehensive Guide

As Singapore heads toward 2025, a deeper understanding of payroll management is looking to become ever more essential for today’s HR personnel. From a fairly comprehensive viewpoint, this guide will allow a reader to learn about its recent changes such as updates to compliance and innovations in technology that affect payroll processing in Singapore. Key […]

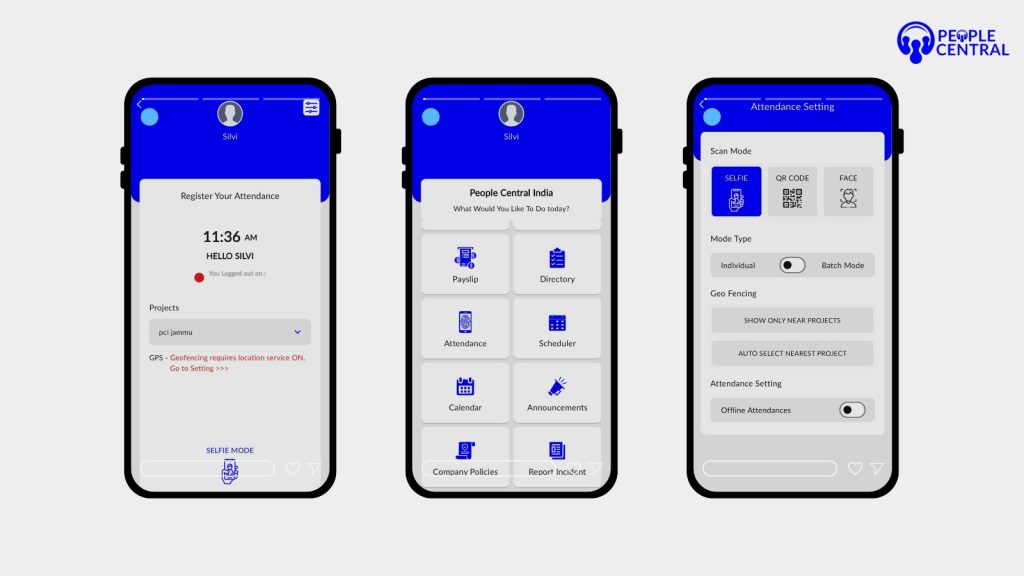

Enhancing Workforce Management with Mobile Attendance in Singapore

In Singapore’s active business climate, workforce management has undergone a radical transformation. Gone are the days of time cards or manual entries, replaced by mobile attendance in Singapore, which challenges fundamentally how businesses manage employees—the most priceless commodity to an organization. The Evolution of Workforce Management in Singapore Singapore has always been in the vanguard […]

Unlocking the Secrets of Learning Agility: A Guide

Learning agility has become one of the most sought-after competitive advantages in a fast-evolving professional sphere in Singapore. As a highly developed city-state known for advances in technology and innovative workforces, Singapore is then uniquely positioned where the ability to learn, unlearn, and relearn has become a precondition of being. Understanding Learning Agility Learning agility […]

Exploring the Peoplecentral Mobile App: A Comprehensive Guide

Singapore’s fast-paced business environment embraces efficiency and connectivity, and the Peoplecentral Mobile Application marks a paradigm shift in the enterprise solutions landscape. As an innovative HRMS mobile application, it is destined to transform workplace procedures, enable employees, and offer its clientele unmatched access to an array of critical HR functions. The Singapore Context: Digital Transformation […]

Garden Leave: A Comprehensive Overview

Have you been curious as to why certain employees are paid to sit at home during their notice periods? Enter the world of “garden leave,” something that is gaining more and more popularity in Singapore’s corporate landscape. To understand its implications further for both employers and employees, let us rewind. What Is Garden Leave Exactly? […]

The Evolution of the BGP Portal: A Historical Overview

The time when businesses had to tackle the mountain of paperwork and make countless trips back and forth to various government offices for their grants is as fresh in my mind as it is for you: the BGP age turned from a snail in a tremendous maze of processes to a running rabbit on a […]

8 Common Mistakes in Business Management Training

An important part of business education in Singapore is the management training that complements the changing dynamics of the commercial arena, which lately is being acknowledged. Given Singapore’s position as the center of global business, training on management ought to meet international standards of excellence. Yet even by this minimum standard, many organizations are mismanaging […]

Strategies for Engaging Managers in Training Initiatives

Someone going for the new management training for managers generally does not consider that this is not something that has actually been put into practice. Few managers have learned to guide themselves through life’s unpredictability and are still in the dark as to practically everything else. Time and again, companies have filed for bankruptcy due […]

How Do You Choose the Right Enterprise Learning Management System?

Dear Learning and Development devotees in Singapore, should you come across this, it’s most likely that you are in search of an enterprise learning management system (LMS) that will provide a significant boost to your organization’s training efforts. Well, you have definitely come to the right place! Let us get into details with the LMS […]

How to File Your IRAS Personal Tax Returns: A Guide for 2024-25

Hello, my fellow taxpayer! While we must endure the messy process of filing our IRAS personal tax returns, I don’t need to tell you how glamorous this is- that’s not a word on your to-do list! But do not worry; this guide will take the problem out of the exercise. Kick back with a hot […]

5

5